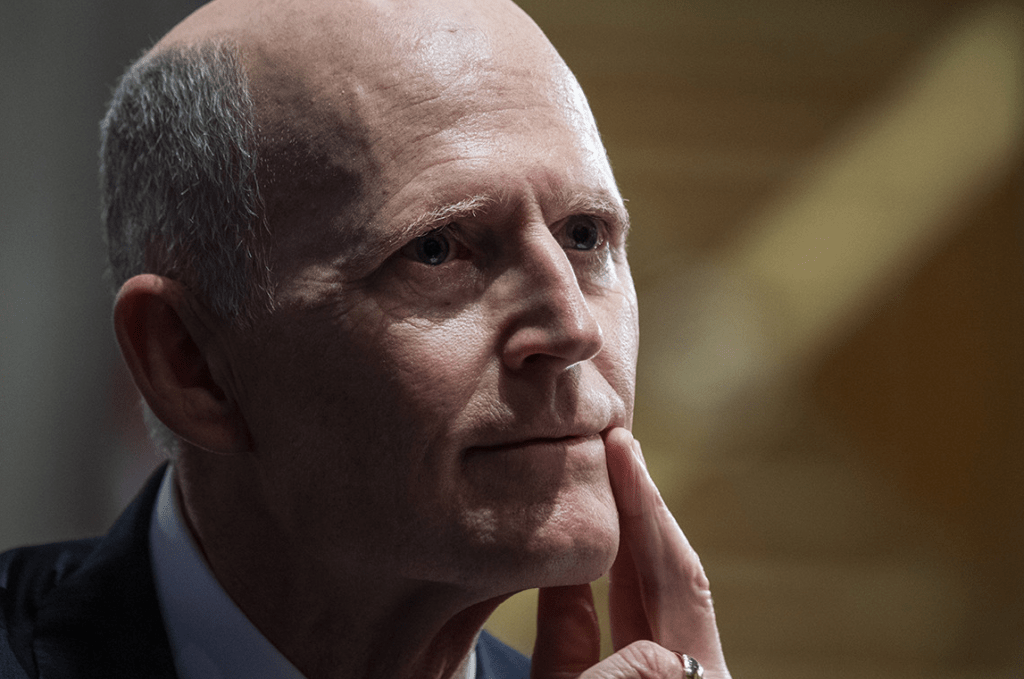

Rick Scott's Path To Financial Triumph

How Rick Scott Made His Money

Rick Scott is an American businessman and politician who served as the 45th Governor of Florida from 2011 to 2019. Before entering politics, Scott was a successful businessman, having founded and led several healthcare companies. His business career began in the early 1980s when he co-founded Columbia Hospital Corporation, which later became one of the largest hospital chains in the United States. Scott served as the company's CEO until 1997, when he sold his stake in the company for a reported $300 million. He then founded Solantic, a healthcare services company, which he sold in 2011 for an undisclosed sum.

Scott's business acumen and success have been attributed to several factors, including his strong work ethic, his ability to identify and capitalize on market opportunities, and his willingness to take risks. He is also known for his conservative fiscal policies and his commitment to free market principles.

Scott's business career has been the subject of some controversy, with some critics alleging that he engaged in unethical or illegal practices. However, he has denied any wrongdoing and has maintained that his success was the result of hard work and dedication.

How Rick Scott Made His Money

Rick Scott, the 45th Governor of Florida, made his fortune in the healthcare industry. Here are 10 key aspects of how he made his money:

- Columbia Hospital Corporation: Co-founded and led one of the largest hospital chains in the US.

- Solantic: Founded a healthcare services company and sold it for an undisclosed sum.

- Stock options: Exercised stock options worth millions of dollars.

- Real estate investments: Invested in commercial and residential properties.

- Other investments: Made investments in various industries, including technology and finance.

- Conservative fiscal policies: Implemented policies that reduced taxes and government spending.

- Free market principles: Supported policies that promoted free market competition.

- Strong work ethic: Known for his long hours and dedication to his businesses.

- Ability to identify and capitalize on market opportunities: Recognized and acted upon opportunities in the healthcare industry.

- Willingness to take risks: Made bold decisions and investments that paid off.

These key aspects highlight Rick Scott's entrepreneurial spirit, business acumen, and conservative fiscal philosophy. His success in the healthcare industry was driven by his ability to identify and capitalize on market opportunities, as well as his willingness to take risks. His conservative fiscal policies and commitment to free market principles have also contributed to his wealth.

Columbia Hospital Corporation

The founding and leadership of Columbia Hospital Corporation (CHC) played a pivotal role in Rick Scott's financial success. CHC was one of the largest hospital chains in the United States, and Scott's leadership and strategic decisions contributed significantly to its growth and profitability.

Scott co-founded CHC in 1987 and served as its CEO until 1997. During his tenure, CHC expanded rapidly through acquisitions and new hospital developments. Scott's leadership was instrumental in CHC's success, and he is credited with transforming the company into a major player in the healthcare industry.

In 1997, Scott sold his stake in CHC for a reported $300 million. This windfall provided Scott with the financial resources to pursue other business ventures and investments. He subsequently founded Solantic, a healthcare services company, which he sold in 2011 for an undisclosed sum.

Scott's success with CHC demonstrates his business acumen and ability to identify and capitalize on market opportunities. His leadership and strategic decisions helped CHC become one of the largest hospital chains in the US, and his sale of his stake in the company provided him with a substantial financial return.

Solantic

The founding and sale of Solantic, a healthcare services company, is a significant component of Rick Scott's financial success. Solantic provided Scott with a substantial financial return, which he used to fund other business ventures and investments.

Scott founded Solantic in 2007, after leaving Columbia Hospital Corporation. Solantic provided a range of healthcare services, including physician practice management, ambulatory surgery centers, and urgent care clinics. Under Scott's leadership, Solantic grew rapidly and became a major player in the healthcare industry.

In 2011, Scott sold Solantic to a private equity firm for an undisclosed sum. The sale of Solantic provided Scott with a substantial financial return, which he used to fund other business ventures and investments. Scott's success with Solantic demonstrates his business acumen and ability to identify and capitalize on market opportunities.

The founding and sale of Solantic is an important part of the story of how Rick Scott made his money. Solantic provided Scott with a substantial financial return, which he used to fund other business ventures and investments. Scott's success with Solantic demonstrates his business acumen and ability to identify and capitalize on market opportunities.

Stock options

Exercising stock options is a significant component of how Rick Scott made his money. Stock options are a type of employee compensation that gives the employee the right to buy a certain number of shares of the company's stock at a set price. When the stock price rises above the exercise price, the employee can exercise the options and sell the shares for a profit.

Scott exercised stock options worth millions of dollars during his time as CEO of Columbia Hospital Corporation (CHC). CHC's stock price rose significantly during Scott's tenure, and he was able to exercise his options and sell the shares for a substantial profit.

The exercise of stock options is a common way for executives to make money. However, it is important to note that stock options are not without risk. If the stock price falls below the exercise price, the employee may lose money on the options.

Scott's success in exercising stock options demonstrates his business acumen and his ability to identify and capitalize on market opportunities. He was able to exercise his options at a time when CHC's stock price was rising, and he made a substantial profit as a result.

Real estate investments

Real estate investments played a significant role in Rick Scott's financial success. He invested in both commercial and residential properties, generating substantial returns through rental income, appreciation, and development projects.

- Commercial properties: Scott invested in various types of commercial properties, such as office buildings, retail centers, and warehouses. These investments provided him with a steady stream of rental income and the potential for long-term appreciation.

- Residential properties: Scott also invested in residential properties, including single-family homes, multi-family units, and land. These investments provided him with rental income and the potential for appreciation as the value of real estate increased.

- Development projects: In addition to acquiring existing properties, Scott also engaged in real estate development projects. He purchased land and developed new residential and commercial properties, generating profits through the sale or lease of these properties.

Scott's success in real estate investments demonstrates his business acumen and his ability to identify and capitalize on market opportunities. He made strategic investments in both commercial and residential properties, and he was able to generate substantial returns through rental income, appreciation, and development projects.

Other investments

In addition to his investments in healthcare and real estate, Rick Scott also made investments in various other industries, including technology and finance. These investments contributed to his overall financial success and demonstrated his diverse investment portfolio.

Scott's investments in technology included companies such as Apple, Google, and Amazon. He recognized the potential for growth in the technology industry and invested in companies that were at the forefront of innovation. His investments in finance included stocks, bonds, and mutual funds. He diversified his portfolio by investing in a range of financial instruments, which helped to reduce risk and increase returns.

Scott's success in other investments demonstrates his ability to identify and capitalize on market opportunities. He made strategic investments in a variety of industries, and he was able to generate substantial returns as a result. His diverse investment portfolio contributed to his overall financial success.

Conservative fiscal policies

Conservative fiscal policies, such as reducing taxes and government spending, played a significant role in Rick Scott's financial success. These policies created a favorable environment for businesses to grow and prosper, which benefited Scott's investments and business ventures.

One of the key components of conservative fiscal policies is reducing taxes. Lower taxes allow businesses to keep more of their profits, which can be used for investment and expansion. This leads to increased economic growth and job creation, which benefits all members of society, including investors and business owners like Scott.

Another important aspect of conservative fiscal policies is reducing government spending. When the government spends less, it reduces the amount of money it takes from the private sector through taxes. This leaves more money in the hands of individuals and businesses, which can be used for investment and consumption. This also helps to reduce the national debt and promotes long-term economic stability.

Scott's support for conservative fiscal policies has been a major factor in his financial success. These policies have created a favorable environment for businesses to grow and prosper, which has benefited Scott's investments and business ventures.

Free market principles

Free market principles played a significant role in Rick Scott's financial success. These principles advocate for minimal government intervention in the economy, allowing businesses to operate and compete freely in the marketplace. Scott's support for these principles created a favorable environment for his businesses to thrive.

One key aspect of free market principles is the reduction of government regulations. Excessive regulations can hinder business growth and innovation. Scott supported policies that reduced regulations, allowing businesses to operate more efficiently and compete more effectively.

Another important aspect of free market principles is the promotion of free trade. Free trade agreements reduce barriers to trade, allowing businesses to expand their markets and increase their profits. Scott supported free trade agreements, which benefited his businesses and contributed to his financial success.

Scott's support for free market principles created a favorable environment for his businesses to grow and prosper. Reduced regulations and increased free trade opportunities allowed Scott's businesses to compete more effectively and expand their markets. This contributed significantly to his overall financial success.

Strong work ethic

Rick Scott's strong work ethic has been a significant factor in his financial success. He is known for his long hours and unwavering dedication to his businesses. This work ethic has allowed him to build and grow several successful companies, including Columbia Hospital Corporation and Solantic. Scott's commitment to hard work and perseverance has been a key ingredient in his ability to overcome challenges and achieve his financial goals.

Scott's work ethic is evident in the way he approaches all aspects of his business ventures. He is known for his hands-on approach and his willingness to put in the long hours necessary to get the job done. He is also highly detail-oriented and takes pride in his work. Scott's commitment to excellence has earned him the respect of his employees and business partners.

In conclusion, Rick Scott's strong work ethic has been a major contributing factor to his financial success. His dedication to his businesses and his willingness to work long hours have allowed him to build and grow several successful companies. Scott's example demonstrates the importance of hard work and perseverance in achieving one's financial goals.

Ability to identify and capitalize on market opportunities

Rick Scott's ability to identify and capitalize on market opportunities in the healthcare industry played a significant role in his financial success. He recognized the growing demand for healthcare services and invested in businesses that met this need. Scott's strategic investments and innovative approaches to healthcare delivery contributed to his wealth accumulation.

- Early Recognition of Market Trends: Scott identified the increasing need for accessible and affordable healthcare services, especially among the elderly and underserved populations. He invested in companies that provided these services, such as Columbia Hospital Corporation and Solantic.

- Innovative Healthcare Models: Scott supported healthcare models that emphasized efficiency and cost-effectiveness. He invested in companies that developed new technologies and streamlined processes to improve patient outcomes while reducing costs.

- Expansion into New Markets: Scott recognized the potential for growth in emerging healthcare markets. He invested in companies that expanded into new geographical areas or offered specialized services, such as ambulatory surgery centers and urgent care clinics.

- Strategic Partnerships and Acquisitions: Scott formed strategic partnerships and acquired companies to enhance his healthcare portfolio. He identified businesses that complemented his existing operations or provided access to new markets.

In conclusion, Rick Scott's ability to identify and capitalize on market opportunities in the healthcare industry was a key factor in his financial success. His investments in innovative healthcare models, expansion into new markets, and strategic partnerships allowed him to build a diverse and profitable healthcare portfolio.

Willingness to take risks

Rick Scott's willingness to take risks was a key component of his financial success. He made bold decisions and investments throughout his career, often venturing into uncharted territory. These risks ultimately paid off, contributing significantly to his wealth accumulation.

One notable example of Scott's risk-taking nature was his decision to leave a stable job at a large hospital to start his own healthcare company, Columbia Hospital Corporation. This was a risky move, as Scott had no guarantee of success. However, he believed in his vision and was willing to take the risk. Columbia Hospital Corporation went on to become one of the largest hospital chains in the United States, making Scott a wealthy man.

Scott also took risks in his investments. He invested in companies that were not yet well-established or had a proven track record. However, he believed in the potential of these companies and was willing to take the risk. Many of these investments paid off handsomely, further increasing Scott's wealth.

Scott's willingness to take risks was not limited to his business ventures. He also took risks in his personal life. For example, he decided to run for governor of Florida in 2010, even though he had no prior experience in elected office. This was a risky move, as Scott was not well-known and faced an uphill battle against the incumbent governor. However, Scott ultimately won the election, demonstrating his willingness to take risks and his ability to overcome challenges.

In conclusion, Rick Scott's willingness to take risks was a key factor in his financial success. He made bold decisions and investments throughout his career, often venturing into uncharted territory. These risks ultimately paid off, contributing significantly to his wealth accumulation.

FAQs About Rick Scott's Financial Success

This section addresses frequently asked questions (FAQs) about Rick Scott's financial success. It provides concise and informative answers to common concerns or misconceptions.

Question 1: What were the key factors that contributed to Rick Scott's financial success?

Answer: Rick Scott's financial success can be attributed to several key factors, including his strong work ethic, ability to identify and capitalize on market opportunities, and willingness to take risks. He also benefited from conservative fiscal policies and free market principles that created a favorable environment for business growth.

Question 2: How did Rick Scott make his money in the healthcare industry?

Answer: Scott made a significant portion of his wealth through his involvement in the healthcare industry. He co-founded Columbia Hospital Corporation, which became one of the largest hospital chains in the US, and also founded Solantic, a healthcare services company. Scott's success in the healthcare industry was driven by his ability to identify and capitalize on market opportunities, as well as his strategic investments and innovative approaches to healthcare delivery.

Question 3: What role did real estate investments play in Rick Scott's financial success?

Answer: Real estate investments were another significant contributor to Scott's wealth. He invested in both commercial and residential properties, generating substantial returns through rental income, appreciation, and development projects. Scott's strategic investments and ability to identify undervalued properties allowed him to build a diverse and profitable real estate portfolio.

Question 4: How did conservative fiscal policies and free market principles impact Rick Scott's financial success?

Answer: Conservative fiscal policies, such as reducing taxes and government spending, and free market principles, which promote minimal government intervention in the economy, created a favorable environment for Scott's businesses to grow and prosper. These policies allowed businesses to keep more of their profits, invest in expansion, and compete more effectively in the marketplace.

Question 5: What can we learn from Rick Scott's financial success?

Answer: Rick Scott's financial success provides several lessons for aspiring entrepreneurs and investors. It highlights the importance of hard work, identifying and capitalizing on market opportunities, taking calculated risks, and embracing policies that promote economic growth.

Summary: Rick Scott's financial success was the result of a combination of factors, including his entrepreneurial spirit, strategic investments, and favorable economic policies. His story serves as an inspiration for those seeking to achieve financial success through hard work, innovation, and a commitment to free market principles.

Transition: The following section will explore...

Tips for Achieving Financial Success Inspired by Rick Scott's Journey

Rick Scott's financial success serves as an inspiration for those seeking to achieve their own financial goals. By emulating certain principles and strategies employed by Scott, individuals can increase their chances of accumulating wealth and securing their financial future.

Tip 1: Embrace a Strong Work Ethic

Scott is known for his dedication and tireless efforts in his business endeavors. Adopting a strong work ethic is crucial for success in any field. It involves being willing to put in the necessary hours, even when faced with challenges or setbacks.

Tip 2: Identify and Capitalize on Market Opportunities

Scott's ability to recognize and seize market opportunities was a key factor in his financial success. By staying attuned to industry trends and consumer needs, individuals can identify potential growth areas and develop innovative products or services that meet those demands.

Tip 3: Take Calculated Risks

Scott demonstrated a willingness to take calculated risks in his investments and business ventures. While it's important to be prudent, calculated risks can lead to substantial rewards. Thoroughly research and assess potential risks before making any significant financial decisions.

Tip 4: Embrace Conservative Fiscal Policies

Conservative fiscal policies, such as reducing taxes and government spending, can create a favorable environment for businesses to grow and prosper. Support policies that promote economic growth and job creation, which can ultimately benefit individuals' financial well-being.

Tip 5: Embrace Free Market Principles

Free market principles advocate for minimal government intervention in the economy, allowing businesses to operate and compete freely. Embrace policies that promote free trade, deregulation, and a competitive marketplace, as these can stimulate economic growth and provide opportunities for individuals to succeed financially.

Summary:

By adopting these principles and emulating Rick Scott's journey, individuals can increase their chances of achieving financial success. Remember, success is not a destination but an ongoing pursuit that requires hard work, dedication, and a commitment to sound financial principles.

Conclusion

Rick Scott's financial journey provides valuable insights into the principles and strategies that can lead to financial success. Through his strong work ethic, ability to identify market opportunities, willingness to take calculated risks, and support for conservative fiscal and free market policies, Scott achieved significant wealth and contributed to economic growth.

The lessons learned from Scott's journey can inspire individuals to pursue their own financial goals. By embracing hard work, innovation, calculated risk-taking, and sound economic principles, anyone can increase their chances of achieving financial success and securing a prosperous future. The pursuit of financial success is an ongoing endeavor that requires dedication, perseverance, and a commitment to sound financial practices.

Yaya Gosselin Wikipedia: Uncover Hidden Facts And Career Highlights

Unveiling Diego Rivera's Legacy: Discoveries From Beyond The Grave

Unveiling The Untold Wealth Of Brigitte Bardot: A Journey To Financial Stardom

Did Rick Scott Used the Medicare Fraud To Build his Political Fortune

How did Rick Steves make his money? Celebrity.fm 1 Official Stars

Rick Scott Net Worth 2023 Jewel Beat

ncG1vNJzZmion6rApr%2BNmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLTOsGSdoZRiv6qvymaqnKekqXqurcqeZKGho2K6sLrEsmWhrJ2h